We inspire people through design and digital automation. All of our apps are offered either as a white-label solution or branded as Cardlay. We provide both an app and a web portal access.

We provide a full app suite of services based on advanced data aggregation, AI, UX-design and innovative back- & front-end software. Our solutions empower partners with an effective platform for increasing core business, retention and new revenue streams.

About our solutions

Our platform is based on an all-in-one advanced software, tech platform and a white-label or branded front end, ensuring a coherent, secure and real-time user experience.

The integrated solutions eliminate any back-and-forth discussion and demanding processes of managing cards, expenses and reclaiming foreign VAT. With real-time handling, notifications and functionality, company spending and tracking of multiple transactions are simple, fast, and immediate. The solutions enable corporations to issue, load, and manage transactions. Enriched and tagged transaction data is transferred directly to EMS/ERPs’ back-end via APIs for expense reconciliation in real-time. And integrates directly with the self-service platform for VAT reclaim.

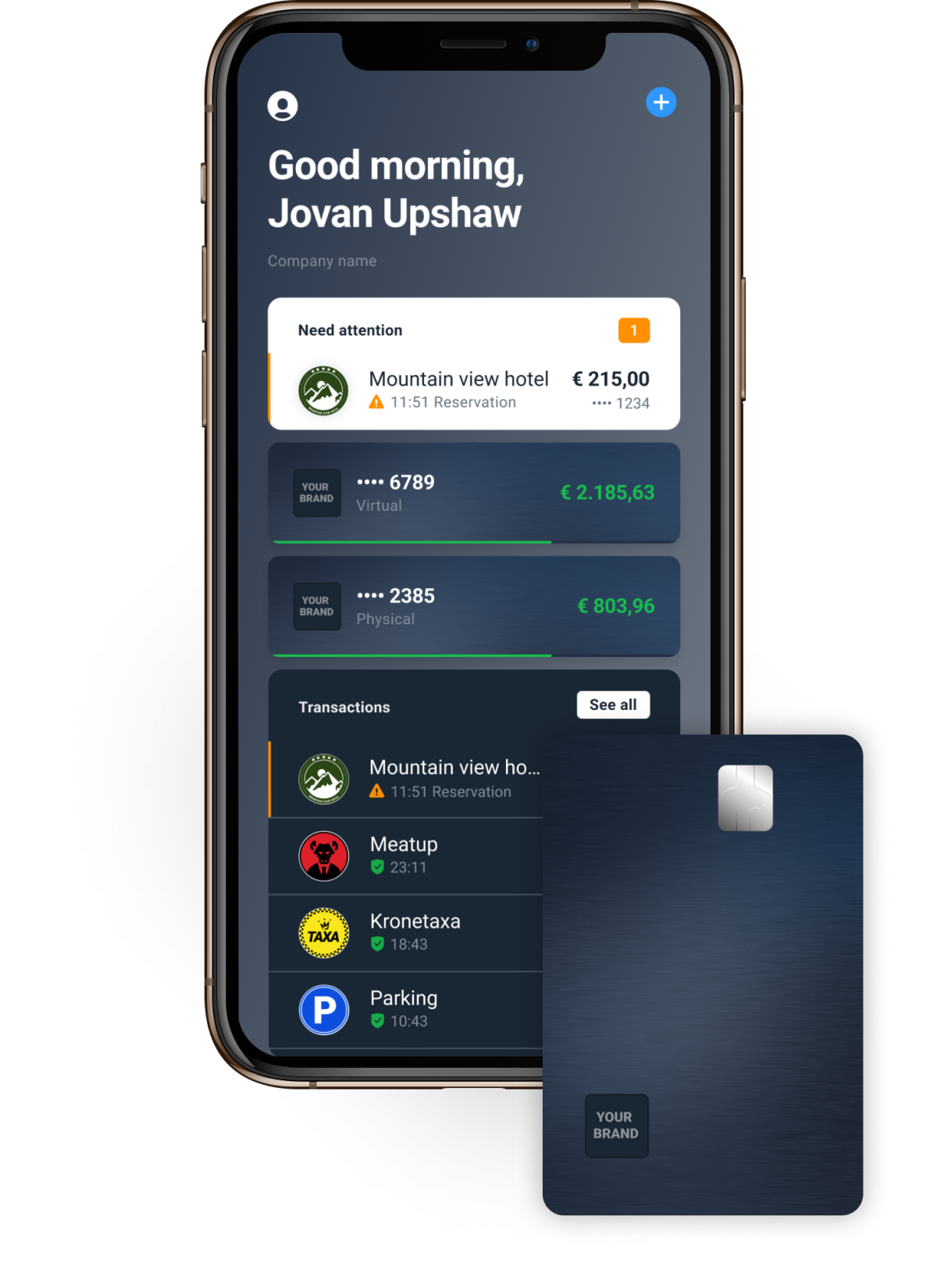

The corporate client app is the mobile front end for the corporate cardholders, and the first line of digital support and service. Cardlay’s corporate app is paving the way for digitalization of the customer relationship through the handling of corporate cards and payments. With our solutions, you can launch new digital services, handle customer activation, reduce cost and manual handling.

By promoting the mobile first philosophy, the corporate client app empowers partners with a tool to introduce new digital services for its customers.

Cardlay offers a full card management solution allowing you to develop and manage card programmes. With the card management, you can introduce many of the services found in traditional bank branch offices, but in a real-time environment managed by the company.

You can leverage our expertise to operate plastic and virtual card programmes, whether it is debit or credit. The card management includes advanced mobile capabilities such as business hierarchy, card issuing, card controls and custom categories. The user experience has been developed specifically for both SMEs and large corporations, and supports both the structures and processes of such organizations.

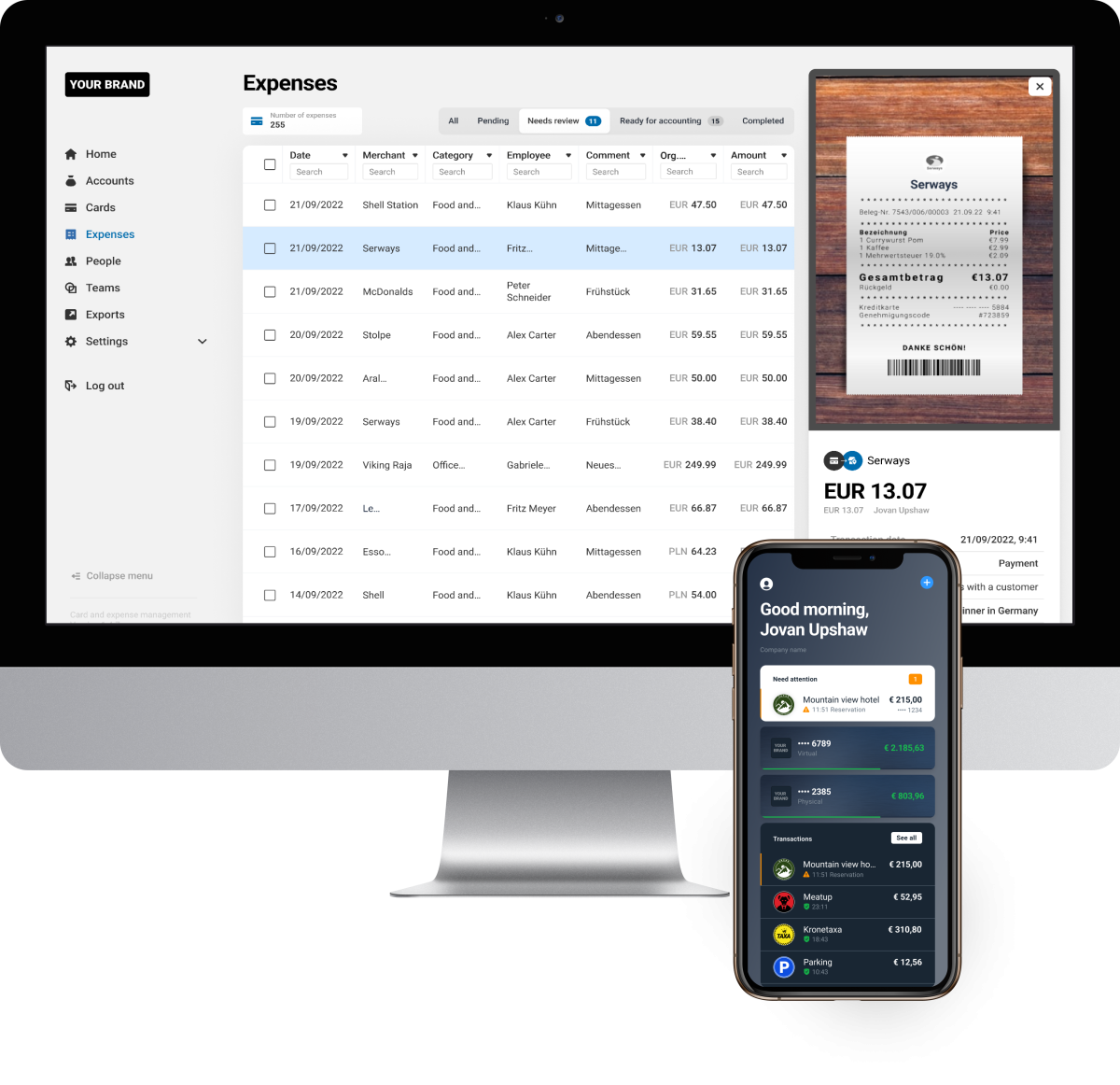

The expense management service delivers a real-time overview of all corporate expenses. All company card transactions and reimbursements for employees are automatically collected and presented through the solution. The cardholder app automatically captures the majority of the account reconciliation information, augmented by the cardholder app where employees can add and enrich transactions with customized information for the company's accounting. Digital receipts can also be uploaded directly into the expense management solution.

Cardlay provides one-click export of data to most ERP systems in order to provide a seamless bookkeeping experience. All transactions are reconsolidated and enriched in real-time, and can be exported on a daily, weekly or monthly basis. Receipts and invoices can be saved to Cardlay’s cloud or downloaded to local file storage.

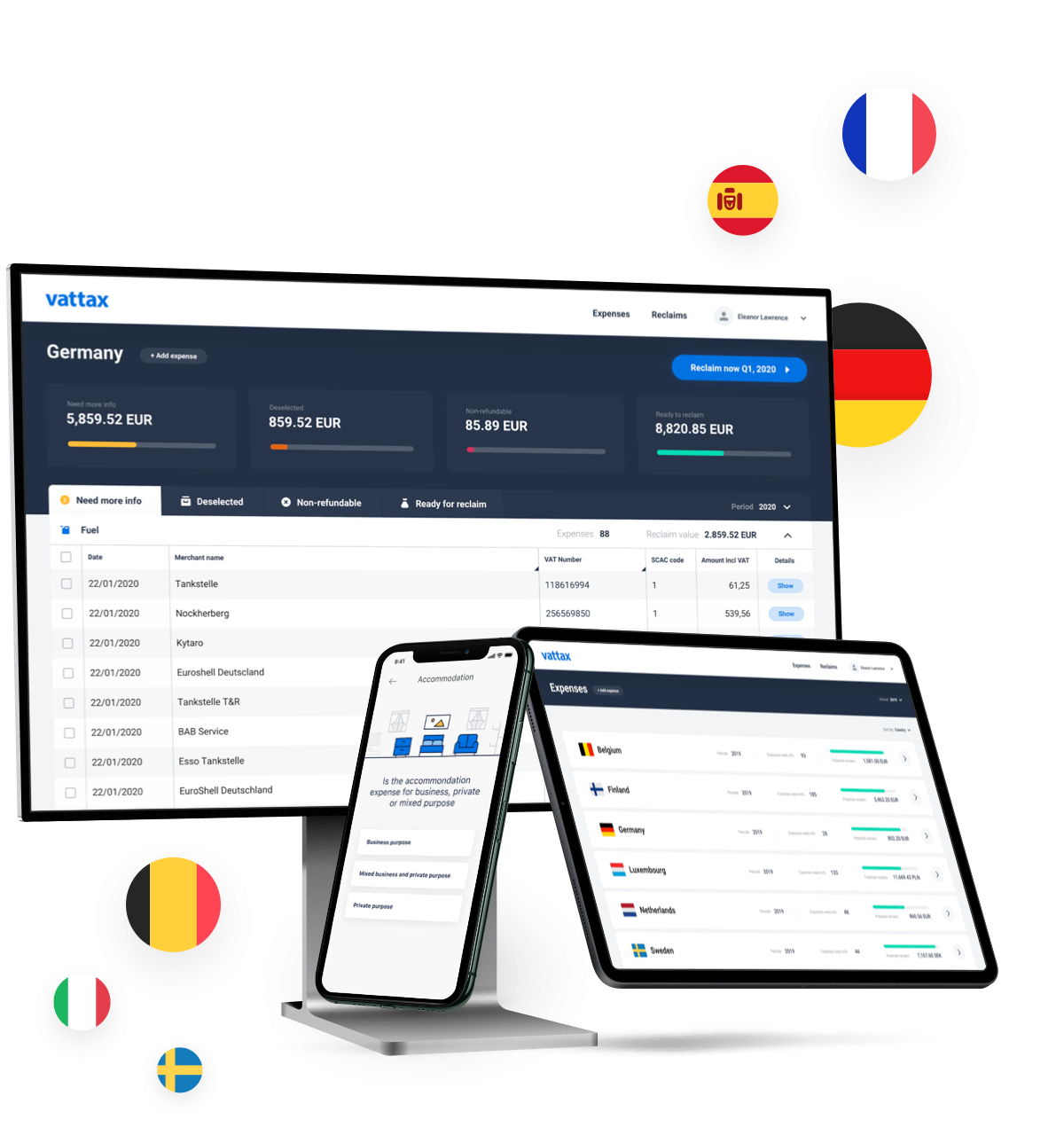

Automatic reclaim EU-VAT with Vattax. When travelling to other EU countries, travel expenses such as hotels, restaurants, car rentals include local VAT. This VAT can be reclaimed, but it is a difficult and time-consuming process. Vattax solves this problem through automation and seamlessly integrates with the cardholder App. Vattax offers a unique overview and power tools for an accounting department that simplifies the reclaim of European VAT.

PwC supplies the needed know-how with their extensive knowledge of VAT and keeps the system up to date with the ever-changing VAT rules in every EU country.

The transaction is received real-time in the app and the cardholder enriches the transaction at the same time as uploading the receipt. The cardholder simply needs to answer the few country specific VAT questions on each eligible transaction to enrich the associated reconciliation data in real-time. The company can add or correct missing information before Vattax automatically processes all claims with reimbursement to an agreed client account.

We’re happy to answer any question you may have, just send us a message via this form.

We’ll get back to you as soon as possible.

Get full control and visibility into company spending, avoid time-consuming paperwork and make life easier for all your employees.

Control company spending upfront

No subscription or set-up fees

PCI-DSS compliant

Want to get full control and visibility into company spending, avoid time-consuming paperwork and make life easier for all your employees? Book a demo now

Control company spending upfront

No subscription or set-up fees

PCI-DSS compliant